Islamic Forex trading has gained significant popularity as more individuals seek ways to engage in financial markets in compliance with Sharia law. For many Muslim traders, the desire to participate in Forex trading while adhering to their religious beliefs is paramount. islamic forex trading https://tradingarea-ng.com/ In this article, we will explore the foundational principles of Islamic Forex trading, its distinctions from conventional trading, and the guidelines traders need to follow to ensure they are compliant with Islamic finance principles.

Understanding Islamic Forex Trading

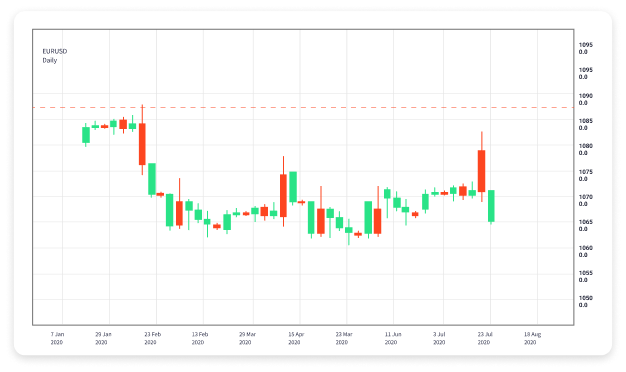

Forex trading involves the exchange of currencies on the foreign exchange market to profit from fluctuations in currency values. Traditional Forex trading often involves leveraging, interest, and speculative practices, which may not align with Islamic finance principles. Islamic Forex trading, on the other hand, strives to adhere to Sharia law, which prohibits activities involving interest (riba), excessive uncertainty (gharar), and gambling (maysir).

Key Principles of Islamic Finance

To fully comprehend Islamic Forex trading, it’s essential to understand the basic principles of Islamic finance:

- Prohibition of Riba: Any form of interest is prohibited. This means that traditional leverage models that require paying interest on borrowed funds are not compliant.

- Prohibition of Gharar: Excessive uncertainty and ambiguity in contracts are not permissible. Transactions should be clear and transparent.

- Prohibition of Maysir: Gambling and speculative behaviors are strictly forbidden. Trading activities should be based on real economic activities and considered risk management.

Contracts and Instruments in Islamic Forex Trading

In Islamic Forex trading, certain types of contracts and instruments are utilized to ensure compliance with Sharia law. Here are some of the most common:

- Spot Contracts: These contracts involve the immediate exchange of currencies and do not involve interest payments, making them compliant with Sharia principles.

- Swap-Free Accounts: Many brokers offer Islamic, or swap-free, accounts that do not charge or pay overnight interest (Swap). These accounts are designed for Muslim traders to avoid riba.

- Hedging: While traditional hedging strategies may involve speculative elements, Islamic traders can engage in hedging methods that do not violate Sharia by ensuring they are based on real exposures and economic purposes.

Choosing a Broker for Islamic Forex Trading

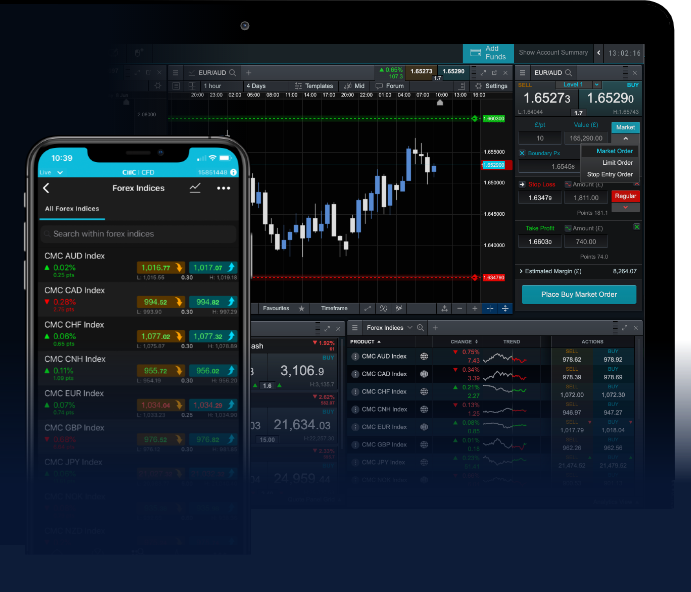

Selecting a suitable broker is crucial for Islamic Forex trading. Traders should seek brokers that provide:

- Islamic Accounts: Confirm that the broker offers swap-free accounts and other facilities that comply with Sharia law.

- Transparency: Ensure that the broker is transparent in their pricing, services, and trading conditions.

- Regulatory Compliance: Choose a broker regulated by a reputable authority to safeguard your investments and ensure fair trading practices.

Trading Strategies for Islamic Forex Traders

Islamic Forex traders often have to adapt their strategies to align with Sharia principles. Here are some strategic considerations tailored for compliance:

- Long-term Investments: Focusing on long-term trades helps avoid frequent trading which could lead to speculative practices. It also aligns with a more ethical approach to investing.

- Real Economic Analysis: Traders should base their decisions on thorough economic analysis and market trends rather than speculative forecasts or gut feelings.

- Risk Management: Implementing robust risk management strategies is vital to protect investments while adhering to the principles of Sharia finance.

The Importance of Education

Education is crucial in Islamic Forex trading. Traders should invest time in understanding both the mechanics of Forex trading and the specific requirements of trading in a Sharia-compliant manner. Many resources are available online, including courses, webinars, and articles that focus on Islamic finance and trading strategies.

Conclusion

Islamic Forex trading presents Muslim individuals with an opportunity to invest and profit without compromising their principles. By adhering to the guidelines of Sharia law and choosing brokers that offer compliant services, traders can navigate the Forex market responsibly. Continued education and understanding of both the financial landscape and Islamic law will aid traders in making informed and ethical decisions.

Engaging in Islamic Forex trading can lead to fruitful financial opportunities while respecting the core tenets of Islam, allowing traders to ensure their activities align with their beliefs. With the right approach and resources, potential investors can successfully participate in the global Forex market in a manner that honors their faith.